Need help? Contact Support: admin@cashconfident.com

Access Available For:

00Hours00Minutes00Seconds

Need help? Contact Support: admin@cashconfident.com

Your Plan:

You Can Look Forward To:

Get intimate with your money and learn how to:

- Monthly Money Mentorship Calls

-

Monthly Small Group Calls for Accountability and Course Q&A

-

Monthly Business Building Calls

-

Access to Full Course Library

-

Access to Past Mentorship Calls

-

Free Digital Journals

Contact Information

Name

Shipping Address (So we can send you a FREE t-shirt!)

*At this time we can only ship to US addresses.

Your Shirt Size

Email

Credit Card Information

| Item | amount |

|---|---|

| Dynamically Updated | $XX.00 |

Access Available For:

00Hours00Minutes00Seconds

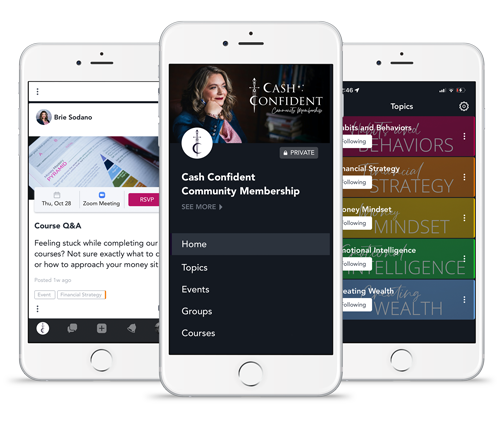

Cash Confident™ is a powerful, encouraging community intended on helping participants have a new relationship with money. Members will get access to content in the areas of Financial Strategy, Money Mindset, Habits, Emotional Intelligence, and Wealth Creation.

Be empowered, Uplifted, & Supported!

You Can Look Forward To:

- Monthly Money Mentorship Calls

-

Monthly Small Group Calls for Accountability and Course Q&A

-

Monthly Business Building Calls

-

Access to Full Course Library

-

Access to Past Mentorship Calls

-

Free Digital Journals

-

Plus, Get A FREE Shirt

Frequently Asked Questions

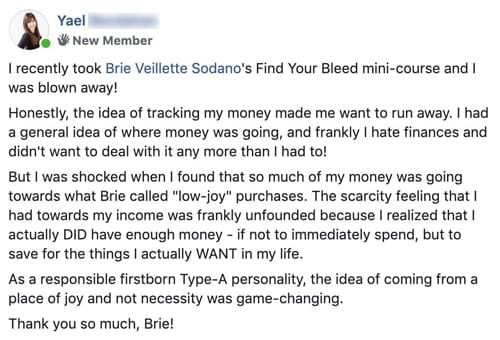

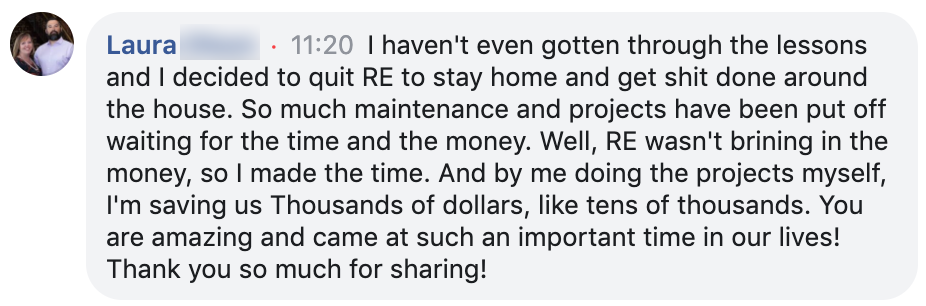

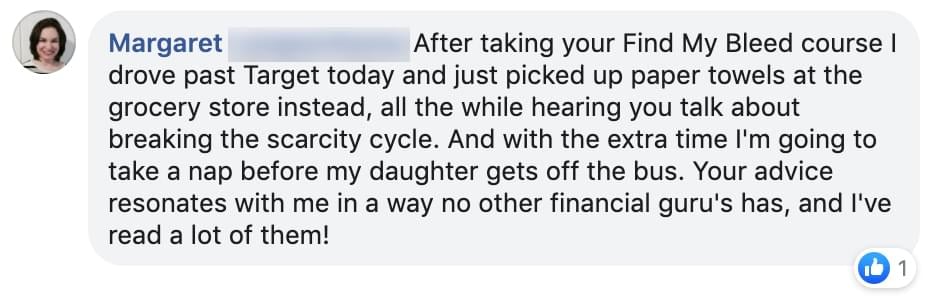

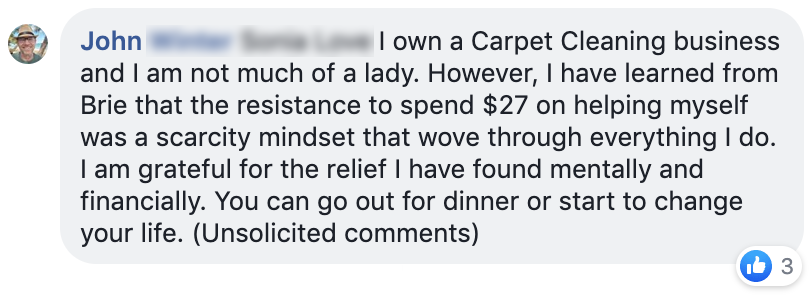

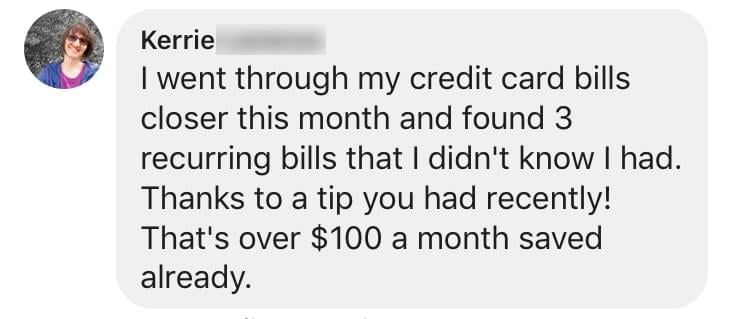

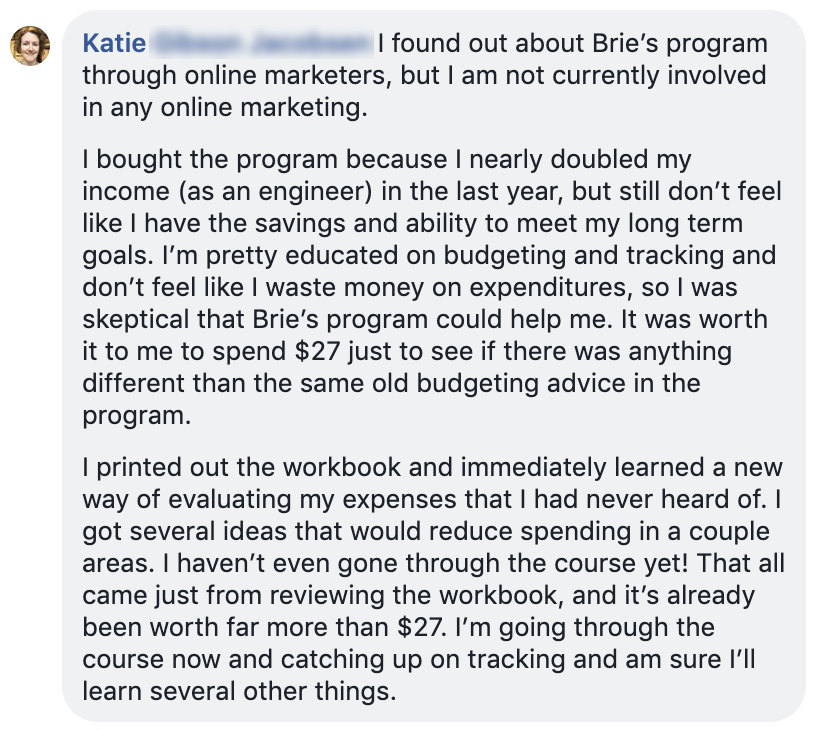

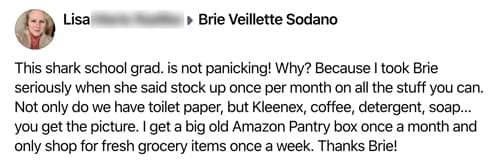

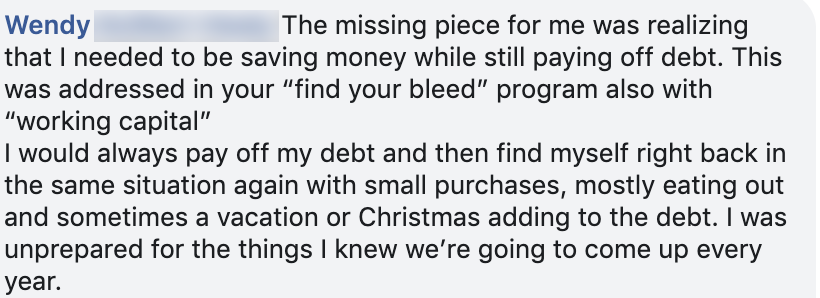

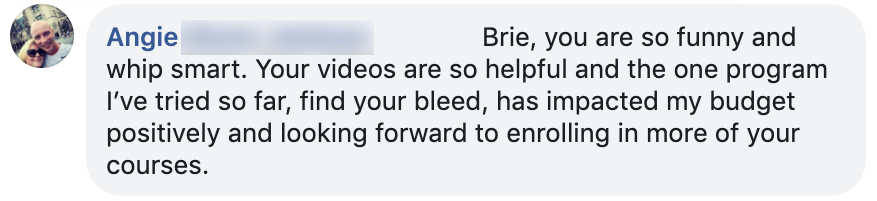

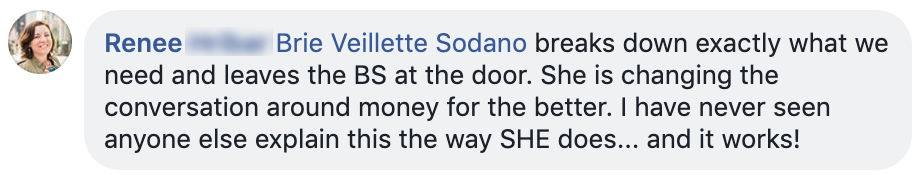

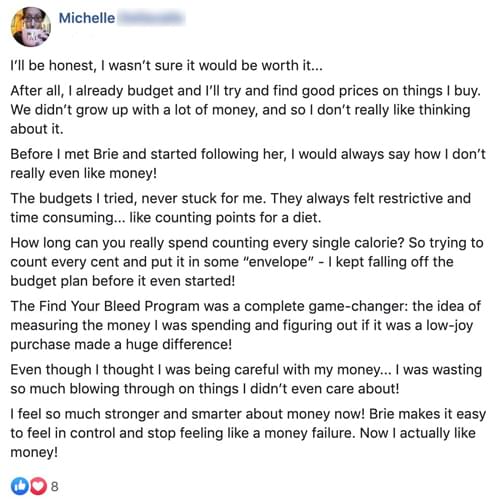

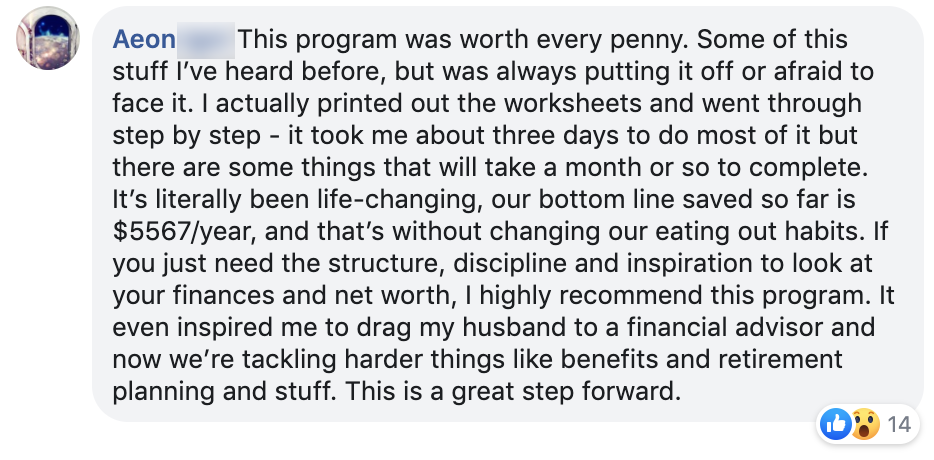

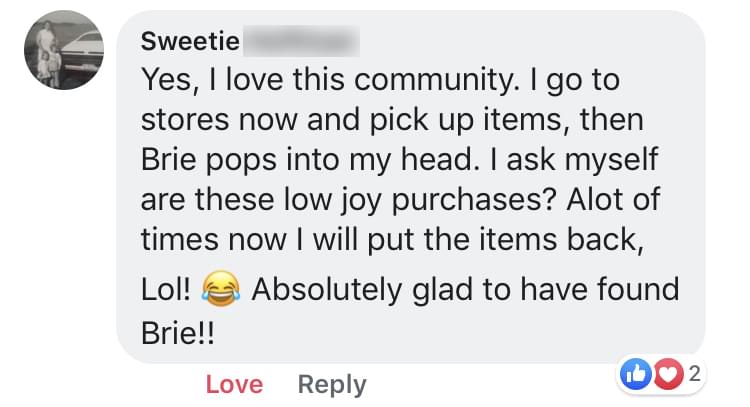

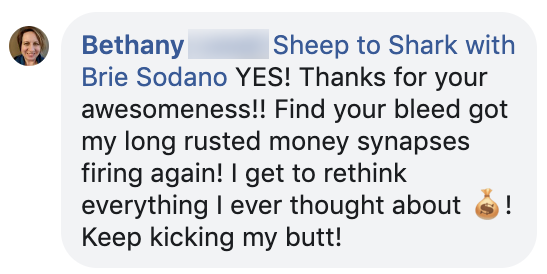

Testimonials

CASH CONFIDENT™ • A MONEY NAVIGATION SYSTEMS, LLC BRAND • COPYRIGHT © 2024

| Item | Price |

|---|---|

| $897/yr |